Matthew J. Previte Cpa Pc - The Facts

Table of ContentsThe Single Strategy To Use For Matthew J. Previte Cpa PcGet This Report about Matthew J. Previte Cpa PcGetting The Matthew J. Previte Cpa Pc To WorkOur Matthew J. Previte Cpa Pc Statements

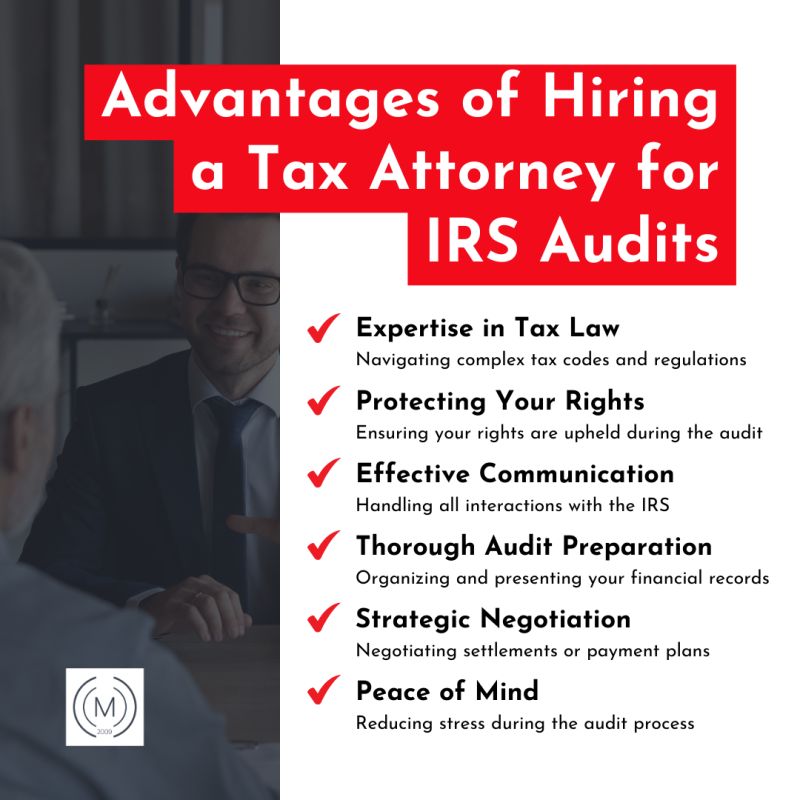

The Irs (IRS) is one of our country's most effective federal government agencies, and when you think about the firm's duty, that fact makes a great deal of sense (https://www.flickr.com/people/200086339@N08/). Besides, the IRS looks after the nation's tax laws and accumulates what taxpayers owe. All these funds go in the direction of maintaining the federal government runningTrying to overturn the agency's authority could land you in major monetary and legal difficulty. In this circumstance, a tax obligation attorney can be important to aiding you browse your tax obligation concerns. A tax obligation lawyer can stand in between you and the internal revenue service. They can work as your lawful supporter when it comes to tax obligation troubles, tax obligation inquiries, and future tax obligation worries.

A tax obligation attorney is a legal expert who has thoroughly researched the analysis and application of tax obligation regulations. These sorts of tax specialists are very competent and have a solid understanding of tax plans at the government and state levels. Tax attorneys have finished from legislation school, obtained a certificate to exercise law, and passed the state bar.

The Only Guide to Matthew J. Previte Cpa Pc

Obtain more information on precisely just how your tax legal representative might help in numerous circumstances listed below. The leading circumstance that warrants the usage of a tax lawyer is when you might face legal consequences as an outcome of your existing tax obligation situation - IRS Seizures in Framingham, Massachusetts. When your taxes are substantially overdue, the IRS has numerous methods to punish you

If you're experiencing a tax obligation dispute with the IRS, after that it's recommended you work with a tax lawyer immediately. You do not want to face the IRS by yourself. You need a professional who has a comprehensive understanding of tax codes. If you're just seeking solid and trusted tax suggestions, then a tax lawyer is a terrific source to make the most of.

Per Internal Earnings Code Area 7421(b)( 2 ), the IRS needs to quit speaking to a taxpayer if they claim they would certainly prefer to consult with a tax attorney, a CPA, or a registered representative regarding their tax circumstance.

The Ultimate Guide To Matthew J. Previte Cpa Pc

You should officially file a power of attorney, otherwise referred to as IRS Form 2848 (tax lawyer in Framingham, Massachusetts). Form 2848 gives the specific called in the type (your tax attorney) the lawful authority to obtain your tax info for the tax years on your form and to represent you in front of the internal revenue service

If the law of limitations on some of your financial debt has already passed, after that your lawyer may be able to obtain the IRS to stop collection efforts by directing out that they have no lawful basis to seek out the funds any longer. Since you have a better understanding of what a tax obligation attorney can do for you, it's up to you to make a decision if you assume you require to work with a lawyer or otherwise

4 Easy Facts About Matthew J. Previte Cpa Pc Shown

These types do not absolve the taxpayer from legal liability. You will still be totally answerable for your tax obligation scenario. It is feasible, however not an assurance, that your tax attorney may be able to lower the total tax obligation financial debt you owe to the internal revenue service. The major means they 'd have the ability to secure a minimized costs for you would certainly be to take benefit of existing internal revenue service tax financial obligation mercy programs such as: Your attorney will certainly not have anymore negotiating power than you as a private taxpayer, however they do have the advantage of knowing about the numerous programs the internal revenue service uses to provide relief to taxpayers.

For example, if the statute of limitations on several of your debt has actually already passed, after that your attorney might be able to obtain the IRS to cease collection efforts by aiming out that they have no legal basis to look for the funds anymore. Since you have a far better understanding of what a tax attorney can do for you, it depends on you to decide if you believe you require to hire an attorney or otherwise.

Comments on “The Best Strategy To Use For Matthew J. Previte Cpa Pc”